EMV (Europay, MasterCard, and Visa) is here!

Conceived by and named for its founders, Europay, MasterCard, and Visa, this EMV is a joint effort is intended to ensure the security and global interoperability of chip-based payment cards. EMV is becoming the new standard for authenticating credit and debit card transactions.

EMV defines a set of security standards for credit and debit card transactions that can be used at point of sale (POS) terminals and automated teller machines (ATMs), and even for NFC (Near Field Communication) mobile payments. Commonly referred to as “EMV cards,” or “EMV credit cards,” these cards use a smart chip instead of a magnetic stripe to hold the data that is required to process a transaction.

It’s virtually impossible to make a counterfeit EMV card because the chip is extremely difficult to tamper with or clone, which has resulted in reduced counterfeit fraud wherever EMV has been implemented.

What is EMV?

EMV is a global payment system that entails putting a microprocessor chip into debit and credit cards, making them less vulnerable to fraud for in-person transactions. Because EMV uses better data security, this standard is being adopted in the United States. In addition, most debit and credit cards will be reissued with EMV chips by October 2016. EMV terminals are already in use all over the world and growing more and more popular everywhere.

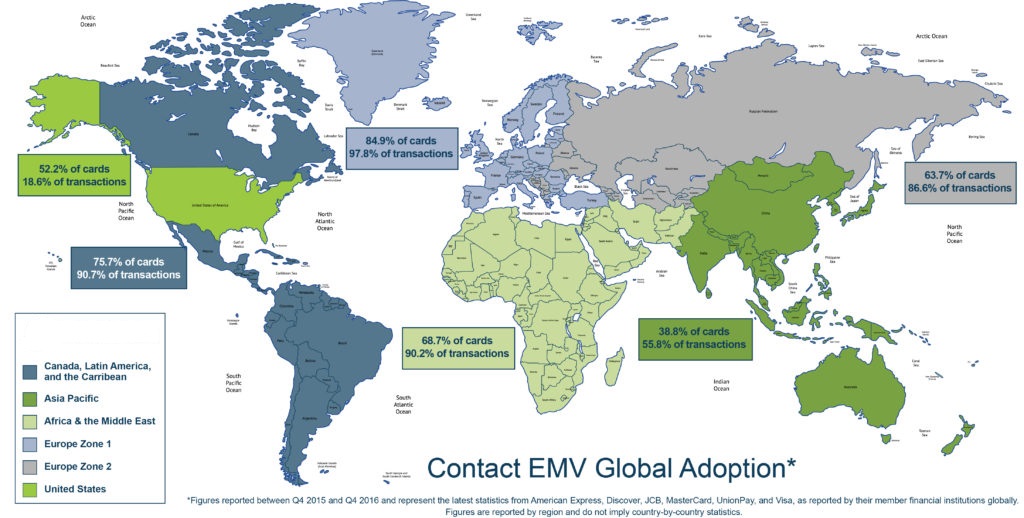

Current Global EMV Terminal Adoption

When is it happening?

EMV has been implemented in more than 80 countries, making it harder for fraudsters in those countries to commit counterfeit fraud. Unfortunately, this fraud is migrating to the U.S. because magnetic stripe cards are easy to clone and a great deal more vulnerable to fraud. As the last G20 to adopt EMV, the U.S. has essentially become the weakest link in counterfeit fraud.

What does EMV mean for me and my business?

On October 1, 2016, Mastercard shifted the liability to ATM owners for fraudulent transactions if an EMV card is used but the merchant chooses to process the payment using the magnetic stripe instead of EMV technology. Merchants can easily prevent this by installing EMV-enabled terminals. Here at National Cash Systems, we’re ready, willing, and able to help you get ahead of the change and make the transition to EMV compliance. Visa is also making this shift as of October 1, 2017.

Even though the adoption of the EMV initiative is voluntary, you don’t want to be the one looking for a chair when the music stops. Missing the final October 2017 deadline for EMV compliance could come with a costly price tag. That date denotes what is commonly called “the liability shift” for ATM owners. After that date, when credit card fraud takes place, liability for the costs will fall on the entity using the lesser technology. In 2016, that liability in the United States is estimated to total more than $10 billion.

After the shift, if a merchant is still using the old methodology and the customer has a smartcard, the merchant is liable for fraud. If the merchant has the new Chip and PIN technology but the bank hasn’t issued the customer a Chip and PIN card, then the bank is liable. If the merchant uses Chip and PIN technology on a smartcard and fraud still takes place, then the credit card company bears the liability, as is the case today.

The EMV initiative expressed as Chip and PIN has been widely adopted elsewhere in the world, and this has driven credit card fraud down to admirably low levels. – France, for example, claims an 80% reduction. Because the chip embedded in a smartcard generates a unique, single-use code for every transaction, hacking to acquire card data is futile. The technology’s proven success at reducing fraud is driving this deadline.

Although meeting Visa’s October 2017 deadline for Chip and PIN deployment will be challenging, it’s doable. Perhaps the most important piece of advice is, don’t wait, start your transition now. The nearer the deadline comes, the greater the pressure on you and your staff. Don’t run the risk of delays caused by forces outside your control such as device manufacturers’ equipment inventory or delivery schedules, software compatibility, or outside consultants’ availability. Call us today at 888.642.2274 for a free evaluation of your EMV readiness!